Sunland Capital Mortgage has been operating for 20+ years as a boutique mortgage brokerage helping thousands of realtors, developers, and final home buyers in achieving their common objectives. We focus on listening to the needs, evaluating the merits of the case, and looking for fast, easy and stress-free home mortgage solutions for all.

We will find the mortgage solution you need, that's our commitment.

Luis Gonzalez

President

NMLS # 391573

With more than 37 years of experience, Luis is THE authority on mortgage lending. He sees things that other industry professionals may overlook, allowing him to help thousands of homeowners purchase and refinance homes. Luis is passionate about finding creative financing solutions for his clients, no matter how complex. He utilizes his dedication to learning, along with his experience and unparalleled insight to better understand the forces that drive interest rates.

By staying up-to-date on the latest complexities of mortgage lending, technology and cutting edge marketing techniques for real estate, Luis has become a vital resource for first time buyers, homeowners, builders and realtors alike.

Angel Gonzalez

Chief Financial & Loan Officer

NMLS # 2600922

With 20+ years of mortgage lending, corporate and structured finance experience, Angel is here to help you get your home mortgage loan (fast, easy, and stress-free). He specializes in solving complex mortgage problems taking you (realtor, developer, and homebuyer) through the mortgage process with ease.

Angel looks beyond automated approval processes and focuses on the minor details that can and will make the difference in finding the right solution for the customer, helping them fulfill their American dream of owning a home, investing in a home, or saving and/or cashing out on an existing home.

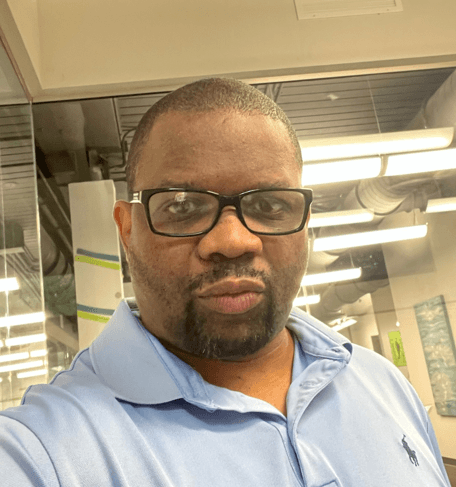

LaMarn ("Lee") Williams

Sr. Mortgage Loan Officer

NMLS # 910141

With 20+ years in the mortgage banking industry, Lee was deep into mortgage lending during the subprime financial crisis of 2008. He has intimate knowledge of most of the critical issues faced then and how they have evolved over time, particularly around government loans and self-employed borrowers. His unique expertise of this product and borrower type makes him a go-to mortgage loan officer when it comes to evaluating the merits and nuances on these areas.