In today's competitive real estate market, understanding the nuances of mortgage options can significantly enhance your ability to serve clients effectively. One option that is gaining traction among homebuyers is the concept of rate buy downs. As a local real estate agent, knowledge of temporary and permanent rate buydowns can provide your clients with valuable insights that may influence their purchasing decisions. In this guide, we'll explore these two types of buy downs and how you can use this information to better assist your prospects.

A rate buy down is a financial strategy that allows borrowers to lower their mortgage interest rate, either temporarily or permanently, in exchange for an upfront payment. This can make monthly mortgage payments more affordable, making homeownership more accessible for many buyers. However, choosing between a temporary or permanent rate buy down requires careful consideration of individual circumstances, financial goals, and market conditions.

Here is a summary of Pros and Cons associated with both options:

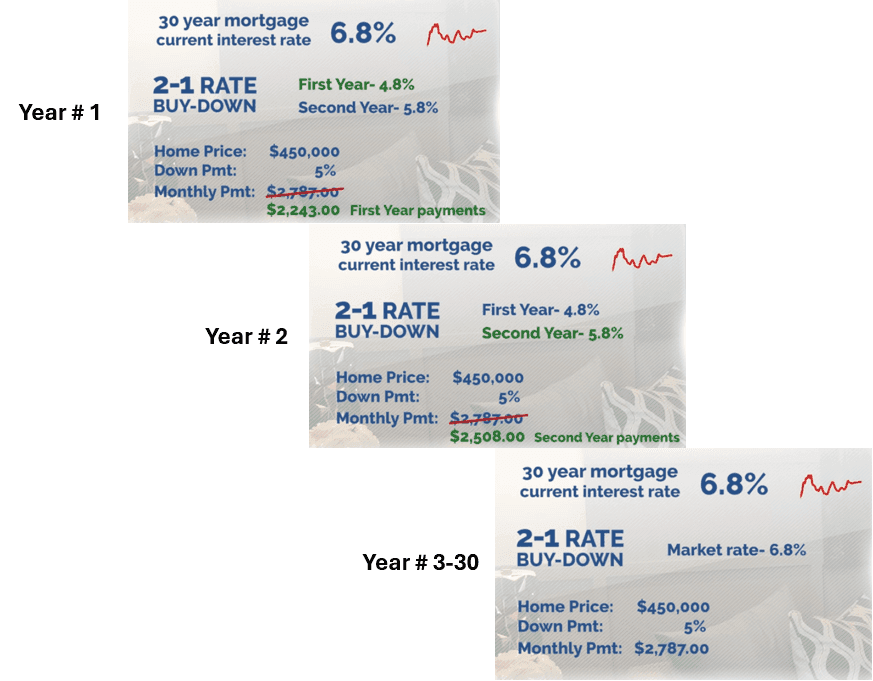

1. TEMPORARY BUYDOWNS:

Source: Trinity Family Builders

PROS:

- Allows the borrower to enjoy a lower interest rate for a specific period, typically the first few years of the loan. For example, a 2-1 buydown where rate will be 6.8% starting on year 3, can start at 4.8% on year 1, 5.8% on year 2, and then become a fixed rate at 6.8% for duration of loan.

- It allows them to ease into mortgage payments, which is especially useful for first-time homebuyers who may be facing additional costs associated with purchasing a home, such as moving expenses, renovations, or new furniture.

- Allows buyers with an expectation of future increases in salary to move into the house at lower monthly payments and be able to absorb the higher payments once the buy down period ends.

CONS:

- Buyers will see an increase in their monthly payments after the temporary period ends.

- Buyers will need to be approved using the higher rate after the end of the temporary period, thus making it harder for some buyers to get approved.

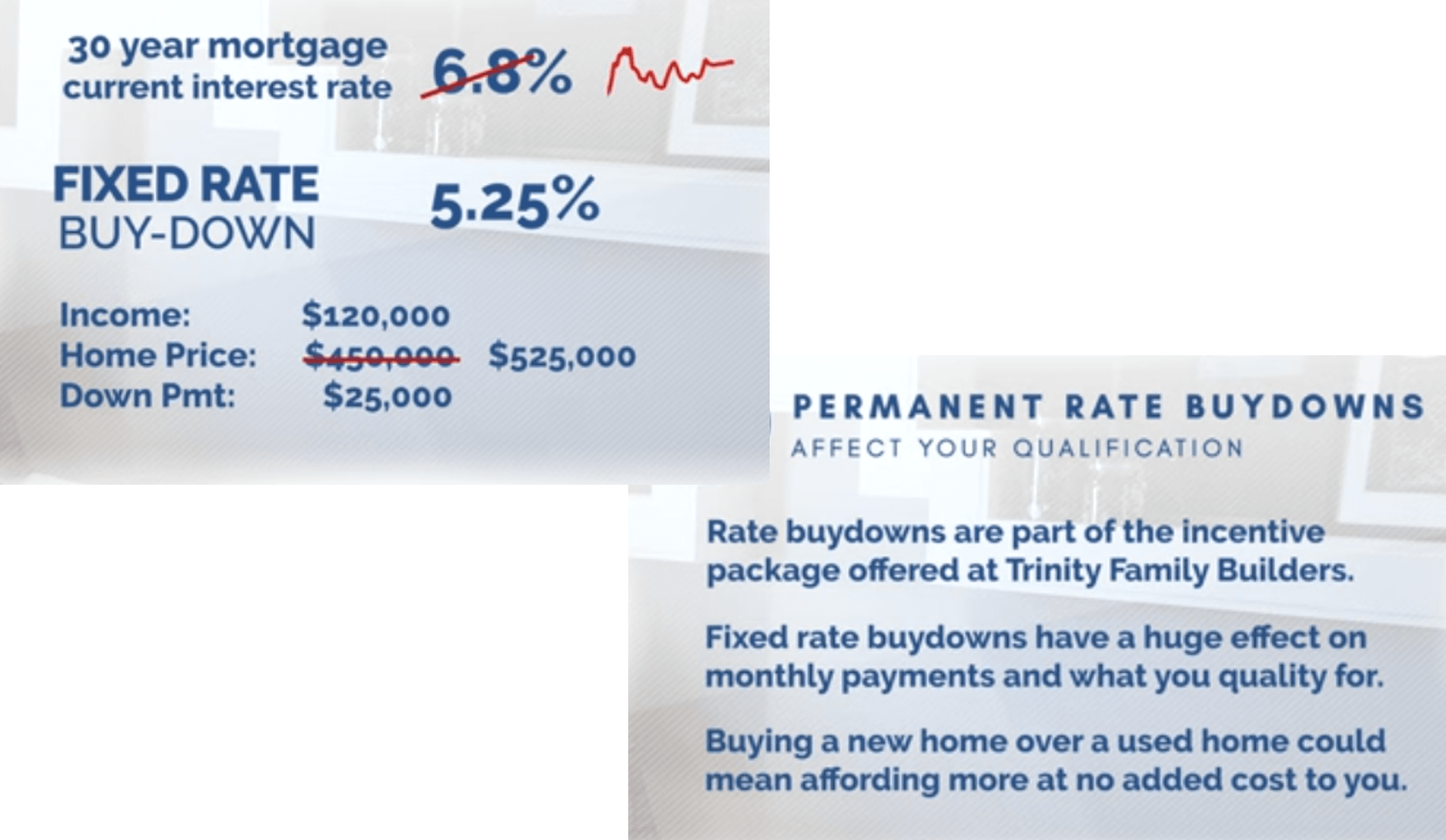

2. PERMANENT BUY DOWNS:

Source: Trinity Family Builders

PROS:

- Allows borrowers to enjoy a lower interest rate for the entire life of the loan. While this option comes at a higher cost, it will provide the greatest benefit particularly if home buyer's plan is to stay at the house without refinancing for a period significantly after the break-even point.

- Allows buyers to secure a lower rate now, and protect themselves from interest rate increases in the future. This stability can be a significant selling point for agents when discussing options with their clients.

CONS:

- This option often requires a larger upfront payment to guarantee a below market interest rate for the life of the loan.

- If not covered by the home builder, for example, in the purchase of a resale home, the cost of paying for the permanent buy down would need to be negotiated with the seller.

When helping clients decide between a temporary and permanent buy down, it’s crucial to assess their long-term financial goals and time horizon. For instance, if a buyer is looking to stay in their home for a short period or plans to sell within a few years, a temporary buy down might be more suitable. Conversely, if they are planning to settle down in the home for many years, a permanent option could save them more money in the long run.

It's also important to consider the costs associated with each option. Temporary buydowns typically involve a lower upfront cost than permanent buy downs, which may be attractive to cash-strapped buyers. However, agents should help their clients evaluate whether the upfront investment in a permanent buy down could lead to greater savings over time.

Another key factor to discuss with clients is the potential for refinancing. In a fluctuating market, a borrower might find that refinancing their mortgage could provide even better options down the road. Educating clients about the possibility of refinancing down the line is essential. By understanding how buy downs work in conjunction with refinancing options, agents can provide a more comprehensive service to their clients.

To further empower your clients’ decision-making, consider suggesting that they speak with a mortgage loan officer for personalized guidance. At our mortgage company, we have a team of knowledgeable loan officers who can explore the intricacies of both temporary and permanent buy downs in detail. They can analyze your clients' unique financial situations, help them understand their options, and guide them toward the best choice for their needs.

Moreover, you can enhance your value as a real estate agent by being proactive in sharing information about buy downs with your clients. Offer to host educational sessions or webinars where potential buyers can learn about various mortgage strategies, including rate buydowns. This not only positions you as a knowledgeable professional but also fosters trust and credibility with your prospects.

As you engage with potential clients, always keep the lines of communication open. Encourage them to ask questions and express their concerns about the mortgage process. Being approachable and responsive will go a long way in establishing strong relationships and can lead to fruitful partnerships.

Furthermore, consider providing your clients with resources or handouts that summarize the differences between temporary and permanent buy downs. Visual aids can help clarify complex concepts and make the information more digestible for buyers who may not be familiar with mortgage jargon. Your goal is to ensure that they feel informed and confident in their choices.

CONCLUSION:

In summary, understanding the differences between temporary and permanent rate buydowns equips you, as a real estate agent, with valuable knowledge that can directly benefit your clients. By helping them navigate these options, you position yourself as a trusted advisor, ready to assist them in making informed financial decisions that align with their homeownership goals.

Take the next step in enhancing your expertise and supporting your clients by reaching out to discuss how we can work together. Our dedicated team is here to provide insights tailored to your specific needs and those of your clients. Let's collaborate to make homeownership a reality for more buyers in our community.